Analytical production costs

Know your actual production costs down to the unit cost. Breakdown by personnel, materials, machinery or depreciation.

Control all your production costs

Define your target manufacturing costs by category: depreciation, personnel costs, material costs or indirect costs.

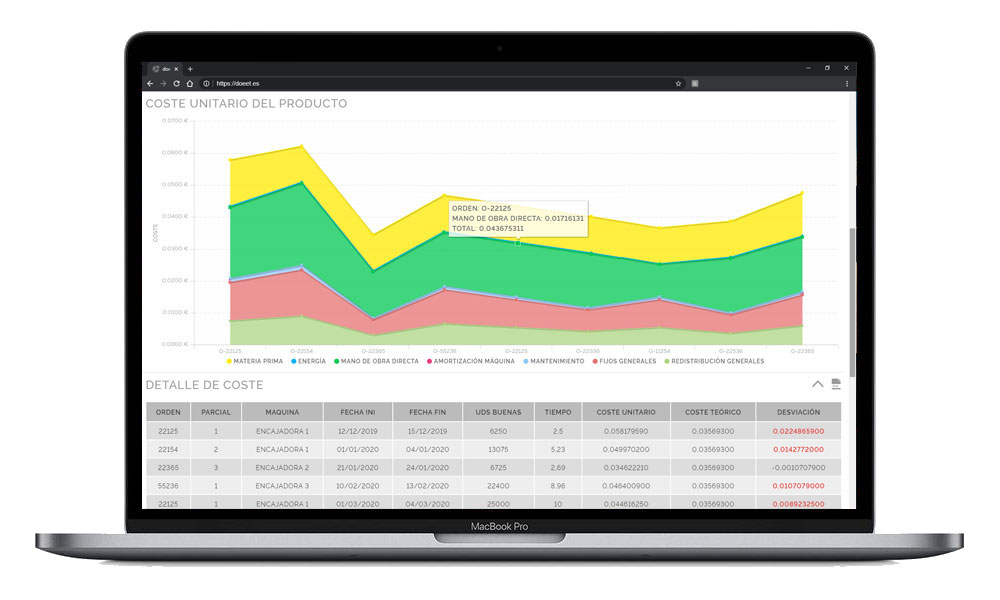

Calculate the actual unit cost of each product and break down the factors contributing to its total cost. Any divergence between actual and target costs is reflected in the cost report.

Your production costs in real time

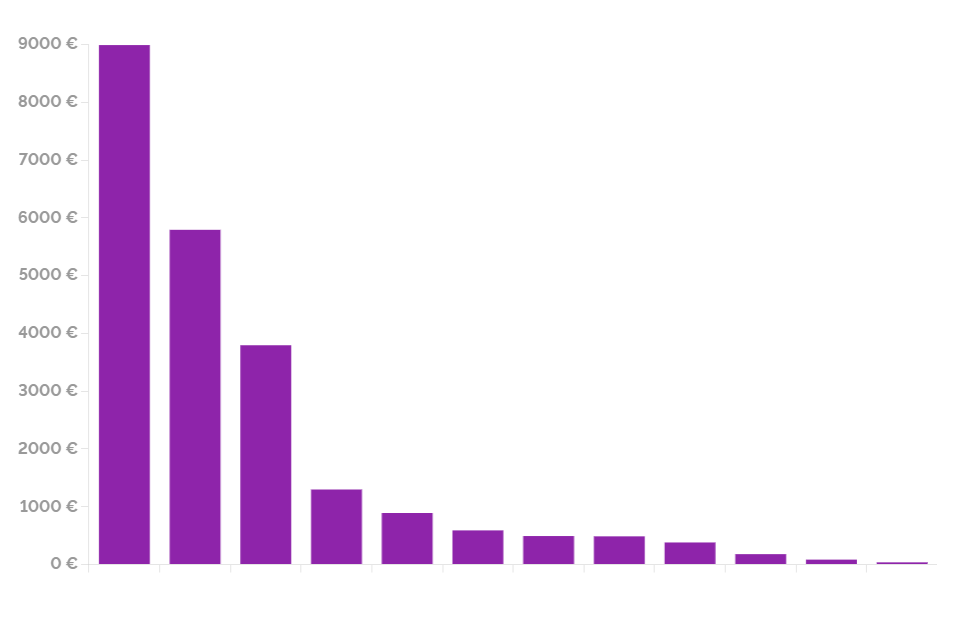

Locate an item and doeet will generate a detailed report with graphs and data on its imputed costs. Doeet monitors all production data, personnel, time, energy, consumption, rejects, stops, slowdowns, etc., thus having all the necessary factors to calculate with high precision the total costs of each manufactured product.

The doeet analytical cost module calculates automatically and in real-time the actual costs of the semi-finished or finished product. The production cost report allows you to analyze, down to the smallest detail, the causes of cost variances.

Avoid costs due to low productivity

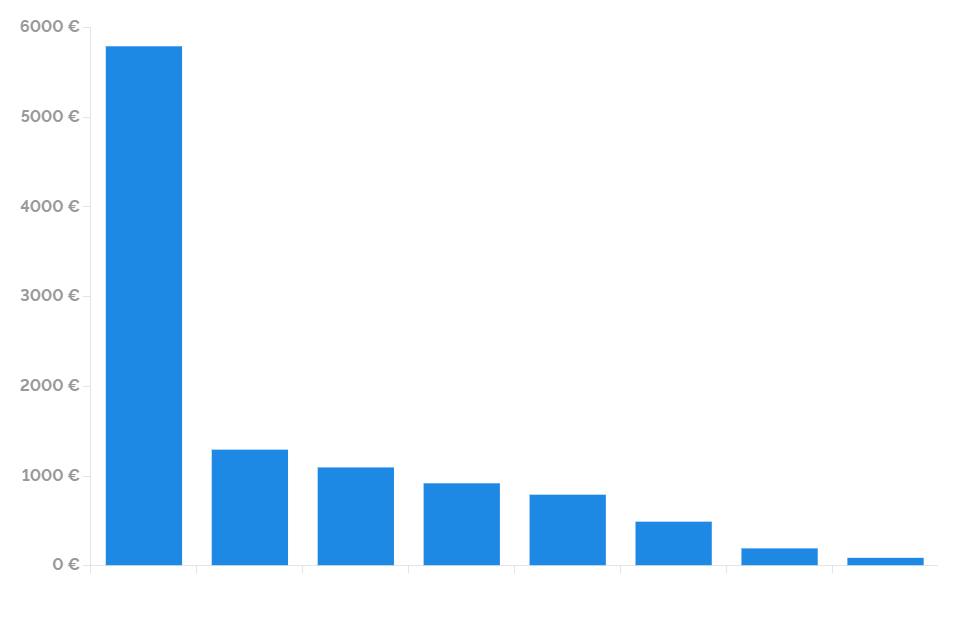

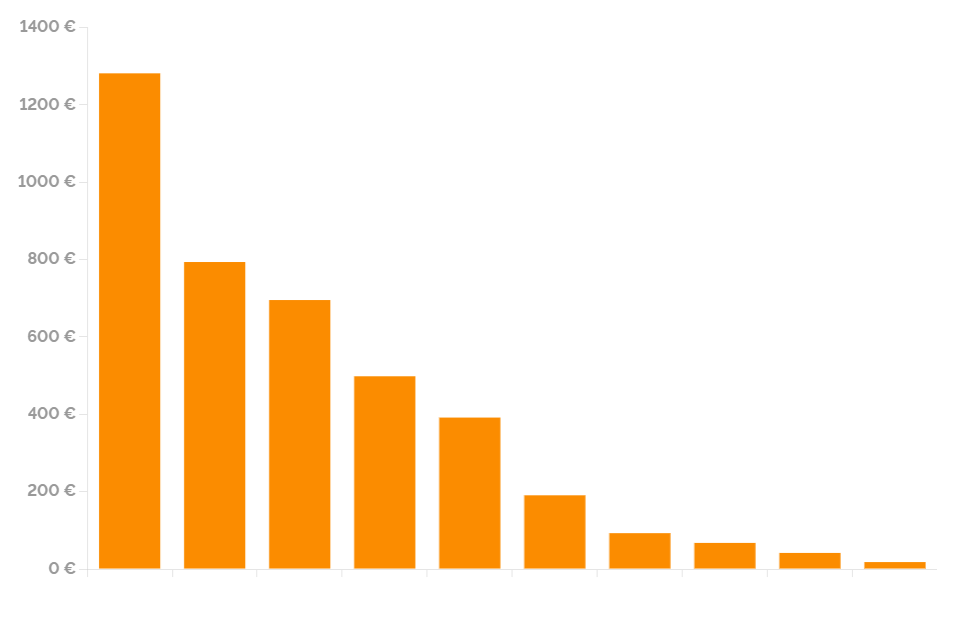

Know the percentage of actual cost attributable to OEE losses. The OEE cost report relates the production costs caused by losses in availability, performance and quality during production.

Analytical costing is a fundamental tool for analytical or cost accounting in industrial operations. The manufacturing cost report allows the investigation down to the smallest detail of the causes of nominal cost variances. The graphs in the report allow you to analyze in depth the real economic losses due to stoppages, slow speed or quality failures and their specific causes.

Breakdown your fixed, variable and indirect costs

Doeet considers all the factors involved in the production of each order to calculate the actual cost of each order and item: fixed, variable and indirect costs, and the sales value.

To know our actual costs and profit margin we must also consider the actual production time, the good units produced or the cost of machines per hour.

Advantages of Production Cost Analysis

Break down and control your direct, indirect, variable or fixed costs.

Analyze in detail your actual costs globally, by order or by item.

Know in real-time when the costs of an item in production deviate and their causes.

Take steps to reduce your manufacturing costs and verify the results.

Costs per item and per order

Once the items and references are registered, you can edit for each of them their fixed and variable costs and their sales value.

The cost-per-order report shows the actual cost to manufacture each work order, accounting for all direct and indirect costs associated with the order.

Machine costs

Indicate the estimated hourly cost of all machines involved in production to know their impact on the final cost of each product.

Analytical production cost functions

- Control of manufacturing costs globally and by production line.

- Unit cost per product and reference.

- Breakdown of direct, indirect, variable and fixed costs.

- Costing of semi-finished and finished products.

- Depreciation and personnel costs.

- Reports and graphs of actual production costs in real-time.

- Charts of deviation of actual costs from their targets.

- Cost deviation alarms.

Other doeet solutions for Cost Control